Future Heroes of Humanity and Heroes of Japan

Noah Smith has a new post, “‘Science’ Without Falsification is No Science,” that questions whether macroeconomics is an empirical science based on solid data. Noah’s post is attracting attention. For example, Mark Thoma comments on it in his own post “'Science’ Without Falsification.’

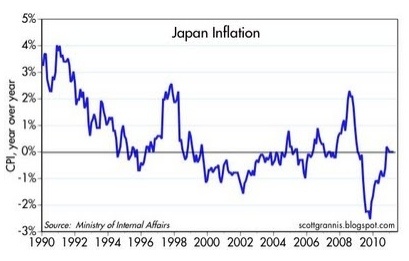

Noah points out that macroeconomists have been arguing over the same things for a long time with no resolution; only decisive central bank actions have provided "experimental” evidence strong enough to convince most macroeconomists of something they didn’t already believe. Just so, massive balance sheet monetary policy on the part of the Bank of Japan could put to rest the idea that balance sheet monetary policy doesn’t work. The Bank of Japan has amazing legal authority to print money and buy a wide range of assets, and has the rest of the government actually pushing for easier monetary policy. So they could do it. They just need to buy assets chosen to have nominal interest rates as far as possible above zero in quantities something like 30% or more of annual Japanese GDP. Japan needs monetary expansion, particularly if it is going to raise its consumption tax, and would be doing the world a huge service by settling the scientific question of whether Wallace neutrality applies to the real world.

I spent two weeks at the Bank of Japan in each of May 2008 and May 2009 precisely because I think there is no central bank in the world that could do more to help the world economy as a whole, as well as Japan’s, by improving its monetary policy. I know that some on the Bank of Japan’s monetary policy committee do not think that printing money and buying massive quantities of assets will work. But the value of experimentation in economic policy is vastly underrated: trying a policy of “print money and buy assets” on a massive scale such as 30% or more of the value of annual GDP is the way to find out. And there is no country in the world for which the possible side effect of permanently higher inflation would be more harmless. The Bank of Japan has officially set an inflation target at 1%, which is 1% higher than where Japan is at, and there would be nothing terrible about having a 2% inflation target, like the inflation targets for the Fed and the European Central Bank. So the Bank of Japan should do it. If the Bank of Japan shifts to such a decisive policy, those pushing for this approach on its monetary policy committee will ultimately go down in history as heroes of humanity as well as heroes of Japan. That statement is written with every ounce of seriousness and passion I am capable of.