An Underappreciated Power of a Central Bank: Determining the Relative Prices between the Various Forms of Money Under Its Jurisdiction

Any unlimited opportunity to lend to the government at a zero interest rate creates a zero lower bound. In practice, when currency regions have gone to negative interest rates, as Switzerland, Denmark, Sweden and the euro zone have, they have lowered their interest rates on reserves, so it is the unlimited opportunity to lend to the government at a zero interest rate by withdrawing paper currency from the bank that seems to be the toughest issue.

The opportunity to lend to the government at a zero interest rate by prepaying taxes is another interesting issue. but as my brother Chris and I argued in “However Low Interest Rates Might Go, the IRS Will Never Act Like a Bank,” for the US at least, it is a limited one, unless the Secretary of Treasury intends to subvert the negative interest rate policy. Once one is paying all one’s taxes at the beginning of the tax year, there is no further available arbitrage on that front, since the between-year tax rate is by law supposed to be set by the Secretary of the Treasury in line with other short-term interest rates.

How can a central bank keep people from shifting their money into paper currency when interest rates are negative? The long answer can be found in all the links in my bibliographic post “How and Why to Eliminate the Zero Lower Bound: A Reader’s Guide.” The short answer can be found in the CEPR’s 5-minute interview with me:

The basic idea depends on one of the roles of central banks that many “Money and Banking” textbooks fail to mention: the role of determining how much, among all the forms of money under its jurisdiction, each type is worth compared to the others. Let me use the example of Japan, since I thought about this issue in the context of writing “Is the Bank of Japan Succeeding in Its Goal of Raising Inflation?” and “Japan Should Be Trying Out a Next-Generation Monetary Policy” last week. Ultimately, it is not the numbers “10000” and “1000” written on them that make a ten-thousand-yen note equal in value to ten one-thousand-yen notes—it is the fact that the Bank of Japan is willing to freely convert a ten-thousand-yen note into ten one-thousand-yen notes and vice versa. Such conversions happen at a part of the central bank so underappreciated that some central bankers don’t even know where it is: the cash window.

It Isn’t the Face Value that Determines How Much Each Type of Paper Currency is Worth. To see this role of a central bank clearly, consider a case where not only direct access to the central bank, but access to the banking system in general is problematic: the criminal underworld. Think of the standard scene in American mob movies in which the mobster demands a suitcase full of cash in tens and twenties. Why tens and twenties? Using the banking system often increases the chance that a criminal will get caught. Money can be laundered, but it is easier to launder tens and twenties. So, at least near the point of money laundering, ten ten-dollar bills are worth more than one hard-to-launder hundred-dollar bill. That means that if you bring me a suitcase full of one-hundred dollar bills with the same face value as a suitcase full of tens and twenties, you are bringing me less value—you have cheated me.

The Exchange Rate Between Paper Currency and Electronic Money. Just as central banks determine the relative value of different denominations of paper currency by how they treat them at the cash window, they also determine how much paper currency is worth compared to electronic money in a reserve account by how they treat the paper currency at the cash window. A reserve account here is a private bank’s bank account with the central bank; for the Bank of Japan, the balance in a reserve account is a number in the Bank of Japan’s computer system. If the Bank of Japan treated a paper 1000-yen note as worth 990 electronic yen, that is what it would be worth. Here is what it means to treat a 1000-yen note as worth 990 electronic yen: (a) when a private bank came to the cash window of the Bank of Japan and hands in a paper 1000-yen note to have the money put into its reserve account the Bank of Japan would add only 990 yen to that private bank’s reserve account; (b) when a private bank came to the cash window of the Bank of Japan and asked for a paper 1000-yen note, only 990 yen would be deducted from its reserve account.

By the phrase “forms of money under its own jurisdiction” I mean forms of money that a central bank has the authority to print or otherwise create in unlimited quantities. If a central bank can create unlimited quantities of two forms of money, it can commit to exchange one form for the other at any exchange rate it declares without any reason to worry that it won’t be able to provide the form a bank wants to change another form of money under its authority into. In other words, the central bank has unlimited firepower for defending any exchange rate it declares between different forms of money under its jurisdiction. Moreover, an exchange of one form of money for another at a declared exchange rate does not, in itself, directly change the quantity of high-powered money under the central bank’s jurisdiction (though altering the exchange rate between different forms of money may).

To emphasize, a central bank can easily defend any exchange rate it declares between paper currency and electronic money–just as, say, the Fed can easily defend the exchange rate between $20 bills and $10 bills–since it has the authority to create as much of either one that banks want to change the other into.

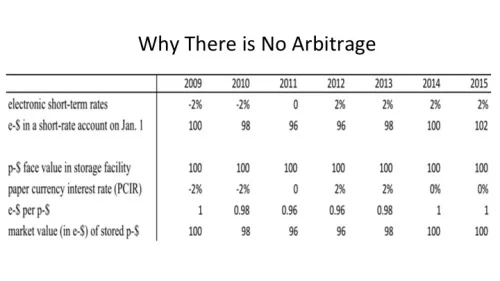

Using the Exchange Rate Between Paper Currency and Electronic Money to Create a Non-Zero Paper Currency Interest Rate. Once a central bank uses it power to determine the relative price of different forms of money under its jurisdiction in earnest, it is straightforward to insure that there is no way to circumvent negative interest rates by storing paper currency. Consider this slide from my presentation “18 Misconceptions about Eliminating the Zero Lower Bound”:

In this example contemplating an alternate history, the central bank has a -2% target rate for two years: 2009 and 2010. To get anything close to a -2% market equilibrium interest rate, the central bank must also reduce it interest rate on reserves to something close to zero. And it needs to reduce its paper currency interest rate to something closer to -2% than to 0. How can it do that? $100 will still have a $100 face value no matter how long it is stored (until cash physically disintegrates). But its market value is determined by how that paper currency with a face value of $100 is treated at the cash window of the central bank. If the central bank treats it as 100 electronic dollars on January 1, 2009, gradually decreasing to 98 electronic dollars on January 1, 2010, and to 96 electronic dollars on January 1, 2011, the rate of return of that paper currency will be -2% per year throughout 2009 and 2010. The idea is to match the paper currency interest rate to the target rate. (One could have a small spread relative to the target rate–say .5% in either direction without causing too much trouble, but the example is simplest if the target paper currency spread is zero.) To match the paper currency interest rate to the 0 target rate in 2011, the central bank need to treat the $100 face value worth of paper currency as $96 electronic throughout 2011. Then with the target rate equal to +2% per year in 2012 and 2013, the central bank can gradually bring the value of the $100 in face value of paper currency back up to being worth $100 electronic around January 1, 2014.

Where the Magic Is. How can an exchange rate between paper currency and electronic money avoid arbitrage without elaborate tracking of each paper note? It is because the rate of change of the exchange rate automatically keeps track of the cumulative paper currency interest rate over the time the paper currency is in private hands–and the paper currency interest rate (really a capital gains rate) is kept equal to the target rate. To reemphasize, it is not the level of the exchange rate between paper currency and electronic money that does the magic, but the rate of change. Just as a sundial keeps track of how much time has passed by how far the shadow has moved, the exchange rate between paper currency and electronic money keeps track of the cumulative interest on paper currency by how far it has moved.

Another Applications of a Central Bank’s Power to Determine the Relative Price of Different Currencies Under Its Jurisdiction: the Electronic Mark.

We are used to thinking of each central bank as having one currency. But it is quite possible for a single institution to supervise more than one currency. I explore the possibilities of a possibility that changes an international exchange rate in conjunction with the exchange rate between paper currency and electronic money in my column “How the Electronic Deutsche Mark Can Save Europe.” The reintroduction of a paper Deutsche Mark would be likely to create immediate, serious problems. The introduction of a purely electronic German mark would work well. In general, when the straightjacket of a single currency becomes too tight, it causes fewer problems to split off a strong currency in electronic form, rather than splitting off a weak currency (as in the worry over Grexit and the reintroduction of the Greek drachma, narrowly averted for now).